In the dynamic world of real estate development, navigating the complexities of financing a construction project is a crucial aspect of success. Whether you’re an expert developer or stepping aboard on your first construction venture, understanding the financial implications of your project is paramount. One can bring in the use of construction loan calculator– which is a powerful tool designed to help the user in the process of estimating costs, planning budgets, and enhancing financing strategies.

Construction Loan Calculator

A construction loan (also acknowledged as a self-build loan) which is designed to finance the construction of a new building or the crucial renovation of an existing property. Construction Loan generally includes the cost of land, labor, material and other expenses related to the construction. Construction loans ordinarily have variable interest rates and may require interest-only payments during the initial construction phase, with the full loan amount payment at the end of the project.

Construction loan calculators tends to be an invaluable mechanism for individuals borrowers and businesses who are associated in real estate projects. Construction loan calculators is an online tool that provides a user-friendly interface to calculate key financial benchmarks which is generally associated with construction loans, enabling borrowers to make informed decisions regarding their construction loans until the project’s life cycle.

How Construction Loan Calculators Work

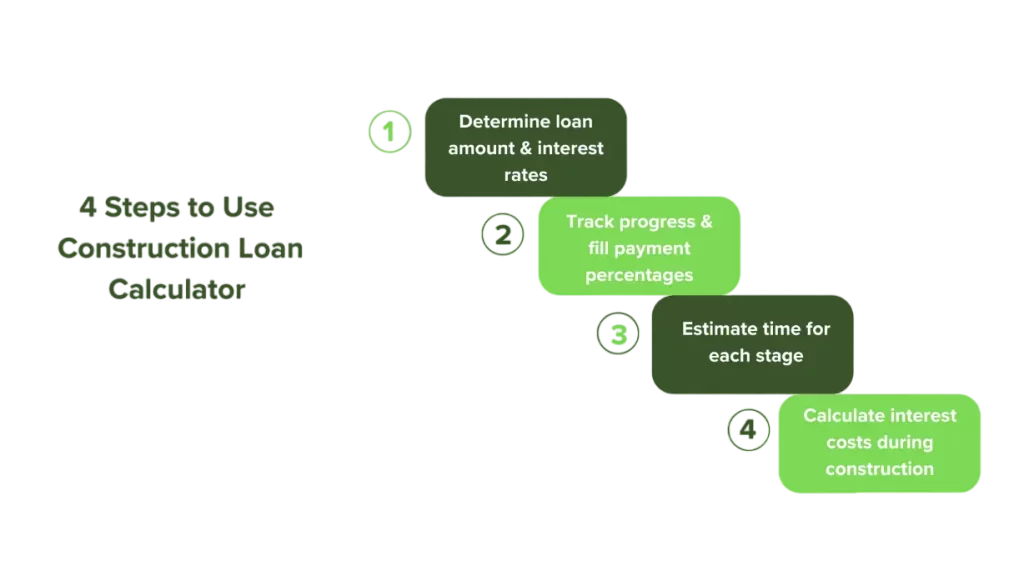

At their midst, construction loan calculators operate on a straightforward principle. Users have to feed in key variables related to their loan, and the calculator will generate inclusive estimates of loan amounts, payments, and amortization schedules.

Construction loan calculators usually show different initial interest rate payments and final interest-only payments, due to the changing loan balance and interest increment during the construction period.

Users have to provide details such as the loan amount, interest rate, construction time period, and any additional fees or costs which they have to take into consideration.

By using this information, the calculator performs complicated calculations to deliver actionable insights.

Construction Loan Procedure

- Initially, borrowers make interest payments based on the disbursed loan amount, which is likely to be lower as construction progresses and funds are released gradually.

- Towards the end of the construction period of the concerned project, borrowers may alter to an interest-only payment period, where they will pay interest accumulated without reducing the principal.

- This final interest-only payment reflects the accumulated interest on the entire loan balance, which is generally higher as the loan amount has reached its peak by the time of project’s completion.

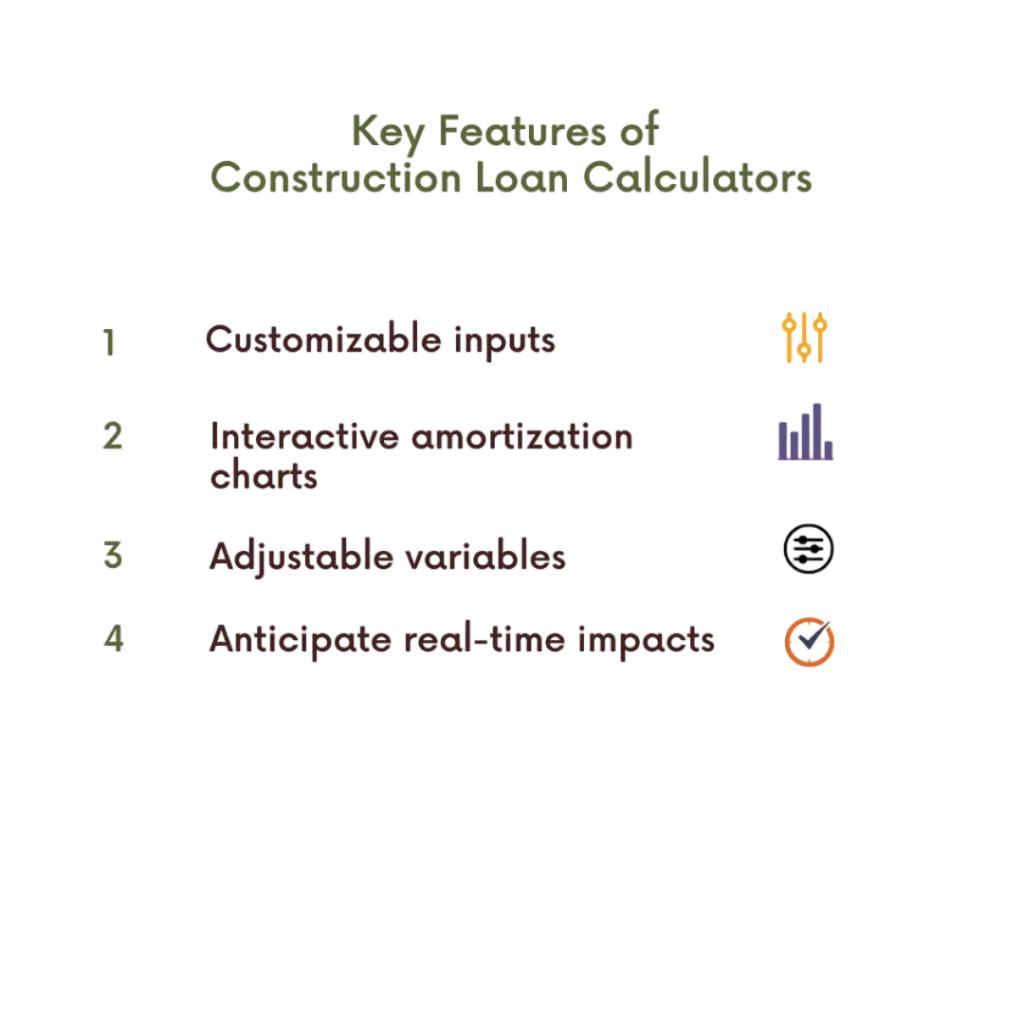

Key Features of Construction Loan Calculator

Construction loan calculators have a range of features that are designed to upgrade usability and accuracy. Some of these features are customizable inputs, interactive amortization charts, which offer a sturdy toolkit for loan borrowers. Calculator allows the users to experiment with different scenarios, adjust variables according to their own choices, and anticipate the impact of their decisions which it will have on their concerned projects in real-time.

Calculating Loan Amount and Payments

One of the primary functions of a construction loan calculator is to determine the appropriate loan amount and corresponding payments. By inputting details such as the project budget, Desired loan-to-value ratio, and projected construction period, borrowers can determine the optimal financing package which will be desirable for their needs. The calculator breaks down monthly payments, including interest and principal components, which will obviously result in providing clarity on cash flow requirements throughout the construction phase.

Loan Amortization

Amortization(an accounting method used to routinely lower the book value of a loan) schedules play a decisive role in interpreting the long-term financial implications of a construction loan. Construction Loan Calculators smoothen this hectic task by generating visual representations of loan amortization, while allowing borrowers to track the gradual reduction of principal amount over time. By envisaging the distribution of payments between interest and principal amount, users get aware about the cost structure of their construction loan financing arrangement.

Exploring Different Scenarios

One of the most compelling features of construction loan calculators is their ability to explore diverse scenarios. Users have flexibility to experiment with varying loan amounts, interest rates, and construction periods to evaluate different financing options. By comparing outcomes across multiple scenarios, borrowers can go for the most cost-effective and sustainable strategy which can suit their project.

Construction Loan Down Payment

The down payment for a construction loan can differ depending on several factors, which include the lender’s requirements, the borrower’s financial condition, and the specific terms of the loan. By and large, lenders may be required to make a down payment ranging between 20% to 25% of the total project cost. However, it is possible that some lenders may offer options for lower down payments, specifically for those borrowers with strong credit records or for those borrowers who qualify for government-backed loan programs.

Moreover, the down payment for a construction loan may also incorporate the value of any land equity which the borrower may have contributed towards the project. It’s crucial for borrowers to discuss down payment conditionality’s with their respective lenders and understand adequately how the down payment can impact the overall financing of their construction project.

Construction Loan Doesn’t Cover All Construction Costs

- Construction Loans have limits which are based on loan-to-value ratios, and it often requires borrowers to lay down a down payment to fill the gaps between the loan amount and total construction cost.

- Contingency reserves generally cover 5% to 10% of the construction cost, as the name contingency reserve itself suggests that they are set aside to cover unexpected expenses, and these contingency reserves are not part of the construction loan amount.

- As there is need for separate funding for handling a number of procedures in construction projects like- land acquisition costs, soft costs like permits and architectural fees, which are usually not covered by construction loans.

How Total Interest Rate is Calculated for Construction Loans?

The total interest rate for a Construction Loan is calculated by combining the interest rates for each phase of the loan, including the construction phase and any successive permanent financing phase. During the construction phase, interest raised on the outstanding balance of the loan is disbursed. Once the construction phase is complete, the loan may be transformed into conventional mortgage or refinanced, and the interest rate may be adjusted accordingly based on prevailing real estate market rates and the borrower’s creditworthiness.

At last the total interest rate is then determined by taking into account the interest rates for each phase of the loan period and their respective durations.

Comparison with Other Loan Calculators

While construction loan calculators share similarities with traditional mortgage calculators, they offer distinct advantages such as:-

- Estimating cost: Like labour, material, permits etc.

- Budget Planning: Help borrowers to plan effectively while avoiding financial surprises.

- Loan Planning: Help borrowers to determine how much they can afford.

- Interest Calculation: How much interest they have to pay during each phase of the loan period.

- Comparison: Help in comparing different loan options.

Construction loan calculator which are designed according to the unique requirements of construction projects.

Tips for Using Construction Loan Calculators Effectively

To maximize the utility of construction loan calculators, borrowers should stick to best practices and grasp the advanced functionalities. It’s essential to input accurate information and account for all relevant costs and fees associated with the loan. Additionally, users should take advantage of customization options and scenario analysis tools which are available to gain deeper insights into their financing options while opting for construction loan.

To Sum Up

Use a construction loan calculator to learn more about financing for construction projects. The application gives users the ability to plan budgets and estimate expenditures, enabling them to make well-informed decisions. Recognize the important financial benchmarks, such as interest rates and payment schedules, related to construction loans. Examine several situations to maximize your project’s funding approaches.

Monitor the loan’s amortization and see how the principal is decreasing over time. Find out how construction loans calculate the total interest rate and what the required down payment is. To prevent unforeseen expenses, weigh your options and make an informed plan. Utilize best practices and cutting-edge features to make the most out of construction loan calculators so you can make well-informed project financing decisions.